With over 150 successful transactions completed in the past 35 years, we pride ourselves in the ability to reduce what can be a very complex and frustrating process of selling or buying a business into one which expeditiously meets our clients’ goals and objectives, combining disciplined process integrity with creativity, alternatives, deal momentum, and a sense of mutually beneficial outcome for all parties.

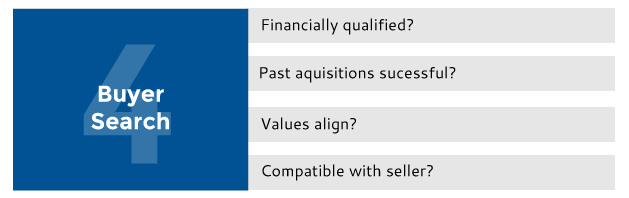

Our success rate of over 90% is a result of carefully screening prospective clients to ensure alignment of values as well as a mutual commitment to a productive business relationship.

Critical to our success is our ability to define and identify prospective buyers for your business or acquisition candidates if you seek to buy a business, and confidentially and discreetly contact them to determine their level of interest.

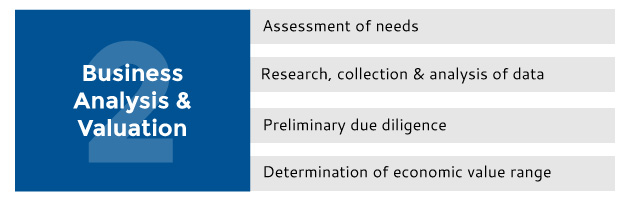

We provide valuation services to assess the current fair market value of your business. Current market value is defined, simply, as what a willing buyer would pay for a business in its current state.

Determining a company’s value involves assessing both qualitative and quantitative criteria that impact a company’s performance. A skilled valuation specialist employs an expertise comprised of financial skills and experiential knowledge of the marketplace, utilizing the correct suite of methodologies to determine an accurate economic range for a business.

A valuation that determines current market value provides a base line for business owners contemplating when and how to exit their companies. We utilize this information to assist our clients in determining ways to add value to the business, or whether it’s time to transition the business to a new owner.

Whether you have answers to the questions below or if you have only begun thinking about any of them, it may be time to begin developing a customized plan to exit your business efficiently, effectively, and on your terms.

- Have you begun to envision “life after the business”?

- Do you have an idea of what financial resources you will need to accomplish this?

- Do you know the fair market value of your business, i.e. what a willing buyer will pay for it?

- Have you had your business appraised to validate what you think it’s worth?

- If your business today is not worth what you feel you need or want to gain from selling it, do you have a strategy to increase its value, either organically or through acquisition?

- Do you have any relatives or employees to whom you’d like to transfer the business?

- If you decide to transfer ownership to family members or employees, do you have a solid plan that ensures you will receive full payment from them? (i.e. if you plan to receive “annuity” payments over time, that they will run the business successfully in order to make the payments)

- Do your plans provide the best return with the least tax liability?

A key benefit of advance planning is the ability to implement a strategic growth plan to maximize the company’s value and to have options in ways to monetize that value.

As a firm we possess financial, sales, and marketing expertise that enables us develop and implement strategic plans for clients with needs to either grow their businesses, return them to profitability, or wind them down outside of the bankruptcy process. Our engagements may precede the sale of the business to increase its purchase price or as stand alone projects.

Integrated Business Ventures offers commercial real estate brokerage services to enhance our value to our clients who wish to sell commercial property, either independently or packaged with the business. Commercial realtors commonly list businesses for sale without accurately appraising the business because the listing is a vehicle to sell the commercial property. We appraise the business and property separately to ensure our clients receive the full value of both entities.

Entering into a business relationship is a marriage of sorts, and we take the courtship very seriously!

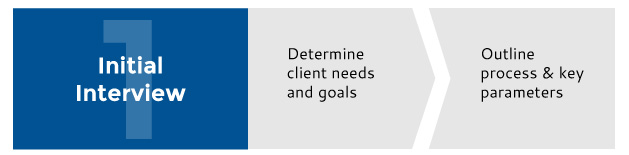

Typically the objective of this first meeting is to find out if there is a “chemistry” between us. We are as interested in learning about your desired life path, your values, and the energetic atmosphere of your facility, as in looking at your financials.

Likewise, you must decide whether we, both personally and professionally, are a fit as an advisory team to assist in your transition.

If we decide to work together, in the next few meetings we collect information to conduct a thorough assessment of issues and options intrinsic to the assignment.

We will assess the various business functions: management, financial, operations, and sales and marketing, to understand the company’s strengths and challenges.

The mechanics of our engagement include a simple agreement regarding the scope of work and expected outcomes. We like our clients to be equally committed to the project’s success – whether it involves selling the business or implementing a growth plan – by trading our expertise and outsourced managerial skills for a mutually agreed upon retainer-based fee structure.

When we are engaged in a mergers and acquisitions project, our up-front fees may be credited against the commission paid when the deal closes.